(3)Cash Incentive Awards granted at zero cost issued under the Omnibus Plan. Cash Incentive awards under the Omnibus Plan which are not exercisable are detailed in the column headed “Equity Incentive Plan Awards” and those which are exercisable are detailed in the column headed “Number of Securities Underlying Unexercised Options Exercisable”

(4)Cash Incentive Awards granted at market price issued under the Omnibus Plan. Cash Incentive Awards granted at market price which are not exercisable are detailed in the column headed “Number of Securities Underlying Unexercised Options Unexercisable” and those which are exercisable are detailed in the column headed “Number of Securities Underlying Unexercised Options Exercisable”

(5)Options issued under the ShareSave plan to US participants. These are detailed in the column headed “Number of Securities Underlying Unexercised Options Unexercisable”

(6)Options issued under the ShareSave plan to non-US participants. These are detailed in the column headed “Number of Securities Underlying Unexercised Options Unexercisable”

(7)Omnibus Full Value Awards, Options and Cash Incentive Awards vested on February 24, 2023

(8)Omnibus Full Value Awards, Options and Cash Incentive Awards have vesting date of February 22, 2024

(9)Omnibus Full Value Awards, Options and Cash Incentive Awards have vesting date of March 1, 2024

(10)Omnibus Full Value Awards, Options and Cash Incentive Awards have vesting date of March 5, 2024

(11)Omnibus Full Value Awards, Options and Cash Incentive Awards have vesting date of May 1, 2024

(12)Omnibus Full Value Awards, Options and Cash Incentive Awards have vesting date of February 21, 2025

(13)Omnibus Full Value Awards, Options and Cash Incentive Awards have vesting date of May 1, 2025

(14)Omnibus Full Value Awards, Options and Cash Incentive Awards have vesting date of February 27, 2026

(15)Options have vesting date of September 26, 2024

(16)Options have vesting date of November 1, 2025

With respect to non-vested or unearned performance based stock options, full value awards, cash incentive awards and SEUs, the number of shares, cash incentive awards and SEUs reported as of December 31, 2023 in the table is based on the performance achieved for each performance goal in the previous fiscal year (2023), except where performance was below the threshold level, in which case the number of shares, cash incentive awards and SEUs reported is based on the threshold level, as detailed below:

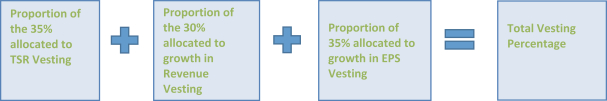

•In the case of the performance-based stock options and SEUs which subsequently vested on February 22, 2024, the number of shares reported is based on achieving 564% relative performance for TSR versus the Russell 2000, 98% increase in EPS per annum and 51% growth in gross revenue as this was the expected and actual outcome.

•For those full value awards and cash incentive awards that expire in February 2032, relative performance of TSR versus the Russell 2000 was greater than the maximum target level; EPS and gross revenue were also greater than the maximum target level.

•For those full value awards and cash incentive awards that expire in February 2033, relative performance of TSR versus the S&P 1500 Chemicals Index was greater than the maximum target level; EPS and gross revenue were also greater than the maximum target level.

•The number of shares reported for Mr. Jones in the case of those which have a vesting date of March 1, 2024, is based on the full achievement of the performance measures, as this is the expected outcome.

The market value of any shares which have not vested is calculated using the year-end stock price of $123.24, as an indication.

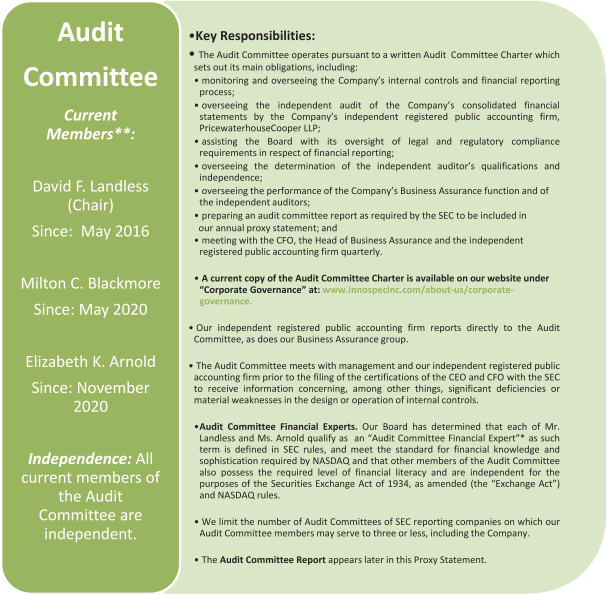

Audit Committee Financial Expert

Audit Committee Financial Expert